The following blog is by Carl Richards originally published in The New York Times’ Blog.

I had a conversation this month with Alison Levine, a polar explorer and mountaineer who has climbed the tallest peak on every continent. While I’m a casual climber in comparison, we do share a love of the mountains and the things they can teach us. In fact, Alison’s new book, On the Edge: The Art of High-Impact Leadership, is full of lessons she learned outside and how they apply to making decisions of all sorts, including smarter ones about money.

Here are the key points from our discussion that you might find useful even if you’ve never set foot in the mountains:

CHANGE: INEVITABLE AND CONSTANT

Before you even reach the mountain, you have a lot of logistical decisions to make. Who will go with you? What equipment will you take? Does the weather look good?

No matter how much thought you put into those decisions, things never turn out the way you thought they would. A storm will blow through. The people climbing with you may react unexpectedly to the conditions. Since things are always changing, we should learn to expect it and then get better at adapting to it. If not, we’ll always be disappointed.

Think of all those times you’ve had your budget blown because of what we often pawn off as a “one-time” expense. If you spend much time at all tracking your spending and comparing it with your budget, you’ll notice a curious phenomenon: There seems to be one-time, unexpected expenses every month. This month, the roof leaks. The next month, the fridge goes out.

The one-time expenses should no longer be a surprise. Start expecting it. Even though you don’t know exactly what it will be, you can create a category for them and call it “surprise” expenses.

SINGLE STEPS

During Ms. Levine’s 2010 Everest climb, she and her team were on the summit ridge. Visibility was horrible, so she couldn’t see very far in front of her. There was a 10,000-foot drop on one side of the ridge and an 8,000-foot drop on the other side.

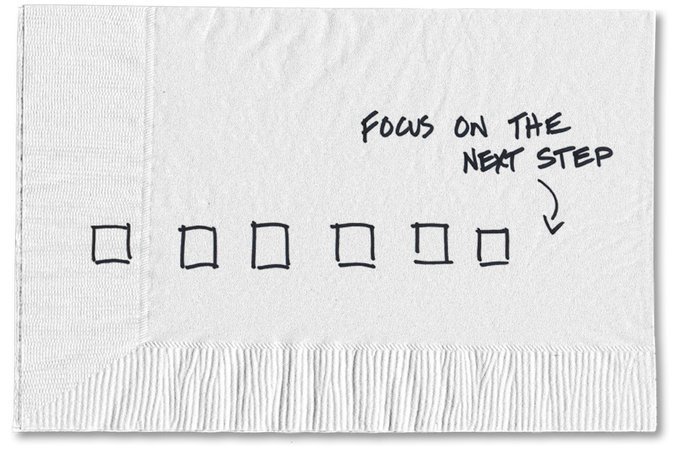

Instead of focusing on the summit she couldn’t see or her fear of going over the edge, Ms. Levine said she eventually reached the top by focusing on one step and then the next step. She didn’t need absolute clarity in order to just put one foot in front of the other; she kept taking those small steps within her little tiny window of visibility.

With money, it’s often a lot easier to focus on some point in the future. But our ability to predict the future of the markets or our own earning power is pretty limited. So what do you know right now? What decision can you make this week? It won’t always be comfortable to take that next step, but we can get better at it with practice and keep moving closer to our goal even though it may be out of view.

EXPERIENCE AND RISK

After 12 years, Ms. Levine accomplished something incredible. She completed the Explorers Grand Slam, which means she climbed the tallest peak on every continent and reached the North and South Poles. Fewer than 30 people have achieved this goal. It’s not surprising since many of us see what she does as very risky.

But here’s the thing: Ms. Levine reacts to this risk differently because she’s spent years getting better at what she does. With every adventure, she learned something she could apply to the next trip. Over time, she has become one of the best in the world at judging the risk she’s facing and deciding if she can manage it.

While a lot of the behavioral challenges we face as investors are almost hard-wired, experience dealing with risk can help us handle it better the next time the markets get scary. If you managed to grit your teeth and stay invested in 2009 when it often seemed like the financial world was coming to an end, that experience will be invaluable the next time markets plummet. You’ve learned that it doesn’t make sense to sell when things are scary.

I had no idea that when I fell in love with the mountains that they’d play such a big role in other areas of my life. The lessons I’ve learned from the mountains remind me that making smarter money decisions doesn’t depend on the newest algorithm or trades made in milliseconds. Instead, it’s about committing to getting a little bit better at it every day.

How have your athletic pursuits helped you manage your money better?

About the author: For the last 15 years, Carl Richards has been writing and drawing about the relationship between emotion and money to help make investing easier for the average investor. His first book, “Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” was published by Penguin/Portfolio in January 2012. Carl is the director of investor education at BAM Advisor Services. His sketches can be found at behaviorgap.com, and he also contributes to the New York Times Bucks Blog and Morningstar Advisor. You can now buy – “The Behavior Gap” by Carl Richard’s at AMAZON.

0 Comments