The following blog is by Carl Richards originally published in The New York Times’ Blog.

“Can it really be that simple?”

Over my career, I’ve heard these words from so many people. Clients, friends and family all just assumed that the process of financial planning needed to be complex. This assumption doesn’t surprise me. The traditional financial industry is built, in large part, on the notion that complexity equals quality. In fact, the more complex the solution, the more someone should pay to access it.

But there’s a problem with this argument: It’s wrong.

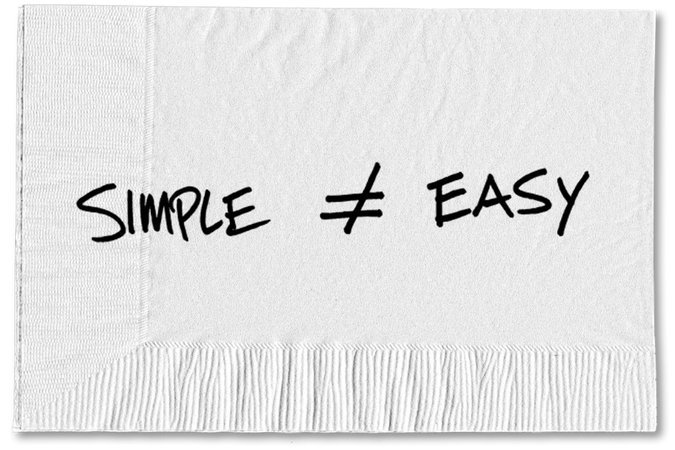

Seekers of financial advice overlook simple prescriptions because when they hear simple, they make the leap to easy. But sticking with good money decisions isn’t easy. So how do we bridge this gap? Here are two things to consider.

Stop confusing simple with easy

People often ask me, “What’s one thing I can do that will have a big financial impact?” I almost universally suggest they spend less and save more. You can imagine the looks I get. That’s too simple. It couldn’t possibly work.

But if it’s so simple, why doesn’t everyone do it? Think about all the simple financial advice we’ve heard over the years. Create and stick to a budget. Avoid unnecessary debt. Save money in an emergency fund.

All of these things are simple, but that doesn’t mean they’re easy. So to avoid the hard choices, we pretend that simple won’t get the job done and go looking for complexity, often in our investments, in order to make up for high spending and low savings.

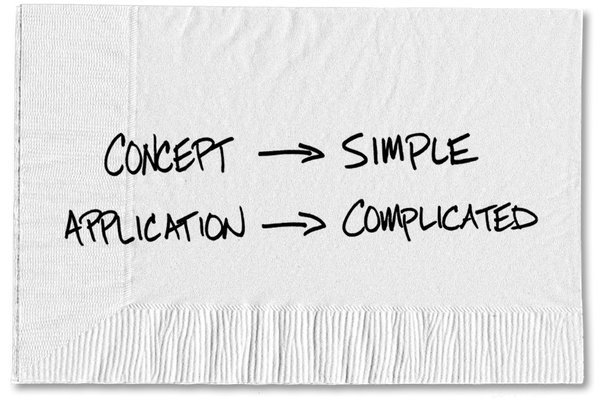

Stop confusing concepts with application

If we all had unlimited resources, life would be easy. But almost every financial decision comes with complicated trade-offs. So when we hear, “Spend less, save more,” we’re likely to ignore it. We have a mortgage. We haven’t had a raise in five years. We have children who always seem to need something. Clearly we need more than, “Spend less, save more.”

Not really. We do, however, need to ask ourselves some difficult questions. Simple solutions put the weight on us to act. Only we know the “why” behind our money decisions. To spend less and save more, we have to dig deeper. That can get messy.

Remember those complicated trade-offs? Suddenly, they’re everywhere. We bought a house that was at the upper end of our budget. We haven’t really done anything at work to merit a raise. We have a hard time saying “no” to our children. So what are we going to do to correct those things or change course?

Whatever the answers, simple solutions bring us face to face with some painful truths about what we are or are not doing, and why. Oddly enough, I’ve found that a lot of people just aren’t comfortable with this process. They’re much more comfortable spending time and money on complicated solutions that don’t require much, if any, self-reflection.

We could keep going down this path or we could try something different. So for one week, I want you to try following a single piece of simple financial advice that until now you’ve always ignored. It will likely be harder than you think, and you may even be tempted to give up by Wednesday. Don’t.

Give yourself one week to ask questions and weigh your decisions without assuming that simple won’t be enough. Along the way, you may discover that simple does more for you than complex could ever dream of.

About the author: For the last 15 years, Carl Richards has been writing and drawing about the relationship between emotion and money to help make investing easier for the average investor. His first book, “Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” was published by Penguin/Portfolio in January 2012. Carl is the director of investor education at BAM Advisor Services. His sketches can be found at behaviorgap.com, and he also contributes to the New York Times Bucks Blog and Morningstar Advisor. You can now buy – “The Behavior Gap” by Carl Richard’s at AMAZON.

0 Comments